IMPACT FINANCE SERIES: Part II – The Markets

In the first article of our Impact Finance series, we sought to demystify the various terms used to describe different investment styles (responsible, sustainable, impact and transition) and themes (environmental, social, climate and green). Here, we move on to consider how the various parts of the capital markets isolate, prioritise and manage specific ESG risks, and how these risks and investments are interrelated through equity, debt and insurance.

Increasing investor appetite

As awareness of social and environmental risk has increased, so investors are increasingly willing to publicly signal their intention to be responsible, and invest in sustainable and impact financing products. What was once widely seen as a niche investment area for “soft” capital, is increasingly understood to deliver commensurate (or better) returns on investment [1] [2], while actively managing and mitigating environmental and social (ES) risks which have previously been ignored.

The Task Force on Climate-related Financial Disclosures (TCFD) has the support of organisations controlling balance sheets totalling $120 trn[3], of which nearly $12 trn[4] is in the private sector. These supporters include the world’s top banks, asset managers, pension funds, insurers, credit rating agencies, accounting firms and shareholder advisory service providers. The Climate Action 100+ represents some of the world’s largest pension funds with over $40trn in assets. UNPRI signatories include asset owners and investment managers with $90trn under management[5].

Product range

Where the capital goes, financial innovation follows. An ever-increasing array of financial products which claim to address ES risks are now available. The product suite is vast and varied and covers the spectrum of equity, debt, insurance and bespoke contractual instruments. Products now exist to isolate and price ES risks. To name but a few:

- weather hedging products for agriculture and renewable energy producers;

- insurance linked securities for property owners and banks exposed to the cost of wildfire, floods, hurricanes, earthquakes, and other natural catastrophes;

- contracts for difference to protect renewable energy producers from energy price risk;

- social impact bonds taking the risk of criminal reoffending rates;

- an array of loans and bonds, sovereign and corporate, which are intended to fund sustainable and impact investments; and

- securitisation of sustainable and impact debt.

Risk capital being put to work to take environmental and social risks is, in principle, a good thing. The more this market grows, the better the cost of these risks will be understood, and factored into decisions by governments and private sector actors alike. The more capital flows into this market, the more regulators and industry bodies will work to formalise and standardise the labelling and reporting which allow investors to understand the impact their capital has, and to trust the sustainable and impact products in which they have clearly signalled their desire to invest.

Capital flows

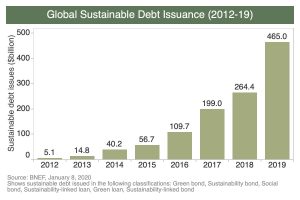

However, the flow of capital is still a trickle rather than a gush. In October 2019, the total amount of sustainable debt in global markets surpassed $1tn, according to an estimate from BloombergNEF[6]. This is nowhere near the tens of trillions under the management of the TCFD, Climate Action 100+ and UNPRI supporter.

The amount of equity which is flowing into specifically sustainable or impact products is harder to pinpoint, but it is growing rapidly. In early 2018, the global sustainable investment alliance estimated that total global sustainable investment had reached $30.7 trillion, a 34 percent increase in just two years[7]. According to the Global Impact Investing Network’s Annual Investor Survey, the impact investments managed by their survey respondents has been doubling year on year, from $114 billion in assets in 2017 to $228 billion in 2018, and had reached $502 billion by April 2019. In March 2020, Morningstar identified over 300 open-ended and exchange-traded funds available to US investors that have sustainable investing at the core of their investment strategy – of which about two thirds were equity funds[8]. The signatories of the Impact Principles declared $182bn of their AUM to be in Impact investments, of which $165bn was in government owned development banks but only $17bn in the private sector[9].

The amount of equity which is flowing into specifically sustainable or impact products is harder to pinpoint, but it is growing rapidly. In early 2018, the global sustainable investment alliance estimated that total global sustainable investment had reached $30.7 trillion, a 34 percent increase in just two years[7]. According to the Global Impact Investing Network’s Annual Investor Survey, the impact investments managed by their survey respondents has been doubling year on year, from $114 billion in assets in 2017 to $228 billion in 2018, and had reached $502 billion by April 2019. In March 2020, Morningstar identified over 300 open-ended and exchange-traded funds available to US investors that have sustainable investing at the core of their investment strategy – of which about two thirds were equity funds[8]. The signatories of the Impact Principles declared $182bn of their AUM to be in Impact investments, of which $165bn was in government owned development banks but only $17bn in the private sector[9].

The exponential growth in sustainable and impact investment should be no surprise given that the investors who have signed up to Climate Action 100+ represent some of the world’s largest pension funds with over $40trn in assets[10]. These investors are seeking to make a positive environmental impact by engaging with companies “to ensure that they are minimising and disclosing the risks and maximising the opportunities presented by climate change”.

While the vast majority of equity investment is done through listed equities, traded on exchanges which don’t classify the investee companies as sustainable, impact or otherwise, there are a growing number of indices which select investee companies based on some sort of ESG screening criteria (e.g. excluding fossil fuel producers). However, indices which screen out the “worst” offenders don’t tell us much else about the sustainability or impact of those they include – nor do they tell us the motivations of the shareholders in making those investments. There is no doubt, however, that companies are seeing increasing pressure from some of the world’s largest investors to address the ESG risks in their businesses. Larry Fink, Chief Executive of Blackrock (which has $7trn under management) has said publicly that “Climate change has become a defining factor in companies’ long-term prospects… awareness is rapidly changing, and I believe we are on the edge of a fundamental reshaping of finance.”[11]

In the insurance linked securities space, the first quarter of 2020 was the strongest Q1 on record for total catastrophe bond issuance, with USD3.8 billion issued[12]. However, less than half of all natural catastrophe losses are insured and this is worse in developing and emerging countries where the proportion of insured losses is still well below 10% and often almost zero.[13] There is clearly room for more risk capital in the insurance market. However, natural catastrophe events such as hurricanes, typhoons, floods and wildfires have had a significant effect on reinsurers (who take risk from insurers). As a result, many investors have experienced losses and some have withdrawn from the space[14].

Are these losses an indication that environmental and social risks are unfinanceable? As any good underwriter will tell you, taking risk is how returns are made – as long as you correctly price the risk. This means equity investors must demand an appropriate ROI, bankers must charge enough interest to cover expected loss, and insurers must charge sufficient premia. The fact that investors taking these types of risks include long term investors like insurers and pension funds sitting alongside hedge funds should be a warning sign. Someone’s view of pricing versus risk must be off.

Product Innovation

In the insurance space, Generali has developed a framework for green insurance linked securities [15]. This is intended to enable all insurance linked securities, not just those relating to natural catastrophe risk to claim the ‘green’ badge. For example, insurance linked securities (ILS) are also used in life and auto insurance. When insurers issue an insurance linked security, the investor takes on the relevant risk of claims arising, as a result the insurer doesn’t need to hold as much capital in reserve. In Generali’s green ILS framework, the insurer would use the freed-up capital to insure further environmental risks. In addition, when the investor takes on the insured risk, they place collateral in an SPV (special purpose vehicle) in case claims do come in. This collateral is invested, typically in treasuries and other very low risk assets. Generali’s proposal is that the SPV use this collateral to invest in ‘green’ financing.

IBRD (part of the World Bank) is already doing something similar. IBRD is insuring natural catastrophe (‘natcat’) risk for Mexico, and has issued a hybrid natcat development bond. The natcat risk is transferred to investors (subject to specific risk parameters), and the IFC uses the collateral to invest in international development. [16]

Weather hedging products traditionally used in the agriculture and construction sectors to manage the risk of crop failure or delays in completion are now being used to help de-risk the project financing and ongoing financial performance of renewables.

In the debt markets, social and sustainability bonds are on the up. Where issuers and investors have previously struggled to scale up the use of social bonds, partly due to difficulties in impact baseline and improvement measurement, this seems to show that where there is an imperative then an investment solution can be found. HSBC expects issuance of social and sustainability bonds between $100bn and $125bn this year[17], up from a total of $61bn ($17bn and $44bn respectively) in 2019[18]. Its estimate of green bond issuance this year is $225 billion – $275 billion (in line with 2019’s $262bn[19]). This expected uptick on social and sustainability bonds is reflective of several large pandemic-related bonds from development banks.

The range of debt products is also expanding, with various London property owners now utilising revolving credit facilities for environmental purposes (more on this in our next Article in this series)[20] [21].

The Sierra Re catastrophe bond issued in January 2020 was the first parametric-based catastrophe bond to cover the risk of earthquakes in a portfolio of mortgage investments.[22] This is unusual in that it’s a rare example of insurance-type products being issued by lenders in order to manage their own exposure to ESG risks.

However, while innovation can be positive, all actors and investors should be sure they understand the risks they are exposed to, what they take on, what they can manage, and ultimately what they pass on. Insurers and investors in natural catastrophe risk and weather derivatives are relying upon historical data and complex stochastic models to price risk, and don’t always get it right. Traditional lending models work out expected loss by looking at very different data such as credit ratings, sector, size and location of business, and financial metrics. These models also fail.

Arguably, reinsurers beginning to price and take ESG risk from lenders improves the management of risk in the financial system. However, we should be wary of any actors who originate risk they do not understand. The idea of lenders blindly trusting reinsurance markets as they did credit ratings and debt securitisation markets is more than a little terrifying. Losses do occur and if pricing or judgement of risk is wrong then the capital reserved may not be sufficient to cover those losses. This is damaging to the whole system – and puts the financial wellbeing of the insured, the bank, the intermediary and the ultimate investor at risk. The providers of capital, the originators of risk, the ratings agencies and the regulators who supervise the entities and the financial system all need to understand the ESG risks involved.

The Assets

Some property owners are in the vanguard of innovation in sustainable and impact financing. In Part III of this series, “The Assets”, we explore how the real estate market is using and driving sustainable finance markets, and the financial risks of falling behind.

[1] Gunnar Friede, Timo Busch & Alexander Bassen (2015) ESG and financial performance: aggregated evidence from more than 2000 empirical studies, Journal of Sustainable Finance & Investment

[2] https://www.qic.com.au/knowledge-centre/esg-fixed-income-returns-20170804

[3] https://www.fsb-tcfd.org/wp-content/uploads/2019/06/2019-TCFD-Status-Report-FINAL-053119.pdf

[4] https://www.fsb-tcfd.org/wp-content/uploads/2020/02/PR-TCFD-1000-Supporters_FINAL.pdf

[5] https://www.unpri.org/pri-blog/pri-welcomes-500th-asset-owner-signatory/5367.article

[6] BNEF – Sustainable debt joins the trillion dollar club

[7] http://www.gsi-alliance.org/wp-content/uploads/2019/06/GSIR_Review2018F.pdf

[8] https://www.morningstar.com/articles/973152/are-sustainable-equity-funds-doing-what-they-claim-to-be-doing

[9] https://www.impactprinciples.org/signatories-reporting as at 7 May 2020, Hillbreak analysis.

[10] https://climateaction100.wordpress.com/about-us/

[11] https://www.cnbc.com/2020/01/14/blackrock-ceo-larry-fink-says-climate-change-will-soon-reshape-markets.html

[12] Aon Benfield Insurance Linked Securities Q1 2020 Update

[13] https://www.munichre.com/en/risks/natural-disasters-losses-are-trending-upwards.html

[14] Aon – Reinsurance Market Outlook January 2020

[15] https://www.artemis.bm/news/generali-develops-framework-for-green-insurance-linked-securities-ils/

[16] https://www.artemis.bm/news/mexico-returns-for-425m-quake-hurricane-world-bank-cat-bond/

[17] Environmental Finance – HSBC raises 2020 estimate for social sustainability bond issuance

[18] Environmental Finance – Bond Database

[19] Environmental Finance – Bond Database

[20] https://www.derwentlondon.com/media/news/article/derwent-london-first-uk-reit-to-sign-green-revolving-credit-facility

[21] http://europe-re.com/cbre-global-investors-signs-green-industrial-loan/67676

[22] https://www.artemis.bm/news/recent-parametric-cat-bond-a-really-important-transaction-swiss-re-ceo-explains/