Are your investments climate proof?

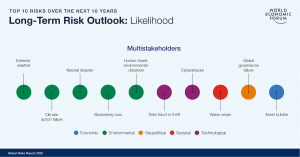

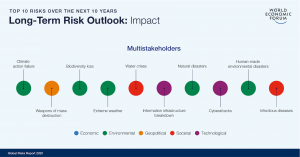

We are currently in the midst of a climate emergency. The latest intergovernmental report released by the IPCC (SR15) states that the world is on course for a disastrous 3 degrees temperature rise, based on the current level of government commitments. On the 15th of January, The World Economic Forum released their Global Risks report for 2020 and climate now tops the risk agenda – dominating the top 5 long term risks in terms of likelihood. This is because climate change is striking harder and more rapidly than anyone had expected. In 2019 we saw extreme flooding in Mozambique, a super typhoon rip through Japan during the Rugby World Cup and of course the fires that still rage today in Australia. Insurance companies estimate these increased climate related disasters have cost $150 billion USD, during 2019.

Risks to assets and business continuity

As the global population becomes more urbanized, there is an acute need for climate resilient buildings and infrastructure in order to ensure they (and we) are protected from the physical and transitional risks posed by the expected increase in extreme weather. Unsurprisingly, there is a developing concept, supported by academic research, that an asset which is climate resilient will also have an associated increased value, and a discount applied to those without – so if you haven’t got a climate resilient asset, it is probably going to become stranded in the future.

One of the key issues is that, even though many businesses have been considering the environmental, social and governance (ESG) impacts of their businesses or assets, until recently the vulnerability or resilience of a building or infrastructure to cope with or mitigate against the impacts of a changing climate have often have not been considered.

So, what needs to change in order for resilient assets and developments to be the new norm? In the UK, for example, perhaps local authorities will introduce climate adaptation conditions attached to planning consents, above and beyond the commonly applied requirement for a Flood Risk Assessment to be undertaken. Perhaps insurers and lenders will become more discerning and explicit about the future climate risk exposure of the assets they are underwriting and reflect that in their premiums, loan rates and covenants. And perhaps asset owners and managers will find it harder to transact without clear evidence of the resilience of assets and portfolios. Whilst there are signs that many of these things are beginning to happen, future climate risk remains an under-stated consideration in strategies and appraisals.

Unfortunately, there is currently a lack of appropriate methods or metrics available for measuring climate resilience at the building or asset level. The current practice of ESG reporting does not reflect how well a building or company is prepared for the risks posed by a changing climate, as the focus has been on mitigating their contribution to exacerbating climate change – greenhouse gas emission reporting / carbon foot-printing. The TCFD, chaired by Michael Bloomberg for the Financial Stability Board, has been an evident catalyst for change, with an increasing number of companies and funds beginning to assess and explain the resilience of their assets under a changing climate, with scenario analysis being undertaken by a small but growing number of real estate organisations. However, when it gets to the more ‘street level’ questions of “which of our assets are at risk to which climate perils and by what magnitude?”, “how might that impact on the returns they generate?” and “to what extent have the measures we’ve undertaken to improve resilience protected our portfolio from downside risk?”, TCFD does not provide such a framework.

Indeed, ask several climate risk modelling vendors to provide a quantified assessment of risk exposure at the individual asset and portfolio level, and you are likely to get several (sometimes very) different answers. This makes the ambition of the TCFD to encourage the issuance of comparable, decision-useful intelligence for investors and lenders across the market something of a stretch, and also means that individual companies and fund managers will need to be confident about the assumptions, data models and methodologies used for any assessments they commission.

Meanwhile, design codes and related modelling conventions are no longer fit-for-purpose, as they are based on historical weather patterns. In addition, sustainable design standards such as BREEAM and LEED, do not make it mandatory to account for exposure to future changes to climate to achieving any certification level – meaning you could be investing in a BREEAM ‘Outstanding’ or LEED ‘Platinum’ building, but it may not be designed to cope with what the future may hold. This makes it very difficult for investors or developers to know that their asset will be fit-for-purpose, both immediately and in the future.

What is the solution?

At Hillbreak, we believe that the industry needs to develop, collaboratively, a unifying climate resilience framework for real assets, that can help to address the ‘street level’ challenges of climate risk – particularly from a physical risk perspective. This tool would enable a clear understanding of whether an office building, for example, has enough capacity to provide cooling in a hotter summer, or if it could be subjected to regular flooding due to more intense rainfall predicted, or if the wind loading is sufficient to withstand predicted future hurricane, typhoon and storm intensity.

In order to make it simpler for investors and developers alike, the logical solution would be to integrate it into existing sustainable assessment tools, making it a mandatory, pre-conditional element to secure any form of rating. However, if these existing tools are not able to change fast enough (history suggests that would be highly probable!), a standalone ‘climate resilience’ certification may have to be most transparent way to communicate and facilitate this, at least in the short-term, applicable to both new and existing assets.

We would be really interested to get your views on this, so please do comment or email us if you have any observations, questions or suggestions.