Hillbreak verdict on Government “MEES” guidance

The Government recently published its guidance to landlords on Minimum Energy Efficiency Standards for non-domestic property, a matter on which much confusion and uncertainty has prevailed. So, have the outstanding issues now been resolved, or do material unknowns continue to cast a headache for the real estate industry? Miles Keeping, who chaired the succession of commercial property groups which advised Government on the regulations, provides his comprehensive take on the new guidance.

Brief background

The Energy Act 2011 (the Act) introduced the concept of MEES in England & Wales. As we know, this introduced a timetable to make unlawful the letting of privately rented property which failed to meet a minimum energy standard of efficiency. In its wisdom, the government decided that energy efficiency should be measured by virtue of an Energy Performance Certificate (EPC) rating, and the minimum standard would be an E (on a scale of A (most efficient) to G). The timetable is:

- 1st April 2018 New non-domestic leases and lease renewals

- 1st April 2020 All residential privately rented properties

- 1st April 2023 All existing non-domestic leases

New guidance was issued by the government on 23rd February 2017.

Uncertainty & doubt

At the time of the publication of the Act, there was a deal of uncertainty as to whether subsequent regulations would actually be enacted – that it would all be too difficult to organise and that the necessary political will would fall away in response to business opposition. Indeed, at the time, there was seemingly a lot that needed to be arranged if regulations were to be forthcoming. The then Department for Energy & Climate Change (DECC) reached out to the commercial and residential property sectors to ask how best to frame the regulations. I was asked the chair the commercial property group and, with significant support from Patrick Brown at the British Property Federation, populated the group with a range of environmental, commercial, legal and technical specialists. The group worked hard, efficiently and openly to support DECC officials.

The regulations (inconveniently named the “Energy Efficiency (Private Rented Property) (England and Wales) Regulations 2015”) arrived and, barring certain issues, were a decent attempt to incorporate a balance of policy intention and commercial practicality. What was clear, however, was that guidance was certainly required in order to put some flesh on the bone in terms of how the regulations should be applied – to get Rumsfeld about it, there were definitely some unknowns, both known and unknown. Some of those concerns related to factors such as how the regulations might apply with regard to Listed Buildings, buildings with whole or partial EPCs and where voluntary EPCs had been registered. There was also confusion as to how MEES might be affected by other law, e.g. the 1954 Landlord & Tenant Act and would MEES apply to licences or just leases?

The commercial property sector reached out to government and offered to pen some guidance. I again chaired the working group which delivered draft guidance to government, after which there was a long hiatus that inevitably refuelled the doubters into voicing opinions that the regulations wouldn’t be implemented. And then, last week, the guidance was published unheralded.

So what does this new guidance tell us that we didn’t already know?

Perhaps the key question to ask is whether the guidance addresses the known unknowns? Well, it does a bit. Let’s have a look at issues settled by the guidance… and where some confusion still exists…

First to remember is that the guidance only covers the non-domestic property regulations; we’ll have to wait for the residential counterpart. Secondly, it only covers England & Wales, Scotland’s s.63 Regulations and Northern Ireland’s 2014 Energy Efficiency Regulations being quite different kettles of fishes.

“Sub-standard property”

The guidance sets out its stall early on by noting that a property which fails to meet MEES is to be known as “sub-standard property”. A small point perhaps, but it’s a phrase which would no doubt stick in the craw of most letting agents; how many landlords would want to go to market with sub-standard properties?

MEES relies on EPCs

Yes, I know you know that, but what some still perhaps don’t appreciate is that MEES only apply to properties where a valid EPC is in place for the property in question and that this has implications in the following situations:

- Voluntary EPCs: Some buildings have EPCs which were commissioned for general asset management purposes (i.e. were not procured because they were legally required such as for a letting of a property). The guidance states that in such circumstances, the existence of a voluntary EPC will not trigger a MEES compliance requirement. Clearly, this will only be relevant at the 2023 trigger date.

- Where whole building EPCs exist but only part of a building is being let: Some buildings, e.g. shopping centres, have EPCs to cover the whole asset as well as for individual units. In such cases, the guidance states that where a whole building EPC exists, only the property being let (e.g. a retail unit in a shopping centre) needs to be improved.

- Listed Buildings: The guidance notes that there is a misconception that listed buildings or those in a conservation area do not require EPCs, because they do unless energy efficiency improvements would unacceptably alter their special character. This is a significant issue and many landlords have chosen to ignore MEES in listed buildings – more about this below.

MEES applies to lettings

I know you know that too, but what constitutes a letting? The guidance is both clear and unhelpful when it states: “the PRS Regulations only apply to properties which are let under a tenancy, non-domestic properties which are occupied under other arrangements, for example properties let on licence, or ‘agreement for lease’ arrangements, are unlikely to be required to meet the minimum standard”. “Unlikely”… What makes it “unlikely”? We need to know whether marketing a property for occupation under a licence would trigger MEES or not? I think we can take it that licences are out of scope of MEES. But what about tenancies at will, for example? Again, our discussions with legal specialists suggest that these would also be out of scope, but a more definitive line from government on such matters would be welcome.

Other exemptions

Other exemptions from MEES exist and it had been thought that an exemption of any nature could negate any need to comply with MEES. The guidance carefully explains that this is not the case – a thread running through various of the exemption categories is that exemptions must be considered as individual issues, rather than in blanket terms. For example, if a suggested improvement measure to a building would have the effect of devaluing the property sufficiently to trigger that exemption, other measures which would not have that effect would have to be undertaken (provided no other exemption applied). Whilst we’re on devaluation, the guidance makes it clear that claiming devaluation will be a rarity.

Another exemption exists when legally required third party consent to undertake improvements cannot be received, such as from a planning authority, superior landlord or tenant; some leases require landlords to obtain a tenant’s consent to undertake improvements within their demise. In such circumstances, the guidance states that landlords must “make, and be able to demonstrate to enforcement authorities on request, ‘reasonable effort’ to seek consent” and thereafter register the exemption in that they “could not carry out the proposed improvements without the consent of the tenant or tenants of the property, and one or more of the tenants refused to give consent”.

Such an exemption would only be temporary, lasting for up to five years or until a tenancy change enabled a new tenant to be approached regarding the improvement. A question which landlords would need to ask themselves is whether the lease provides for them to be able to enter the property to make improvements – presumably, if so, such an exemption would be negated.

Part 2 of the Landlord & Tenant Act 1954 provides security of tenure provisions to tenants at lease end. The guidance is clear that sub-standard property status does not provide a complete exemption from MEES in such circumstances but does allow for a six months exemption from renewal for necessary works to be undertaken. Equally, landlords cannot refuse a renewal nor tenants prematurely terminate a lease because the property is sub-standard.

Landlords and tenants seeking to let or sublet sub-standard properties will need to be aware that whilst any measures which fail the seven year affordability payback test will not need to be undertaken (but registered as such, with three quotes from suppliers and calculations which prove that point) but any measures which do meet the affordability test will have to be undertaken. In other words, one expensive measure does not negate the need to undertake cheaper measures, so landlords will need to ensure they check all potential measures included in their energy assessor’s reports. Furthermore, assessors may suggest that measures which individually fail the affordability test be packaged together such that they then pass the affordability test. However, landlords are not required to install packages if they opt to install a discrete measure instead.

Registration of exemptions

All exemptions must be registered on the publicly available PRS exemptions register – importantly, this must be undertaken prior to an exemption being relied upon. It is also worth noting that should an affordability exemption be relied upon, its registration must be made before any price changes (e.g. in energy or potential improvement measures) have the effect of making potential measures affordable.

Those registering exemptions will need to provide evidence to support their view that an exemption is appropriate and in some cases this might be quite extensive. For example, exemption from undertaking potential measures because they would fail the seven-year payback affordability test will require the submission of a spreadsheet of calculations for all suggested measures and quotations from three suppliers/installers with cost information to support the exemption case.

So where are we now?

The new guidance does give us some clarity relating to how MEES will need to be implemented but it also throws up some new uncertainty. I feel certain, for example, that landlords with listed buildings will be rightly unsettled by the guidance which reminds us of the poorly drafted EPC regulation: It’s a nonsense, impractical and open to differing interpretations. I’m also sure that the uncertainty in the guidance about licences being “unlikely” to be required to meet MEES will delight the legal profession but not landlords and tenants. There will no doubt be some confusion about which EPCs might be considered as “voluntary” and those relying on exemptions will perhaps be surprised by the amount of work which will have to be undertaken for these to be able to be relied upon.

What should landlords be doing?

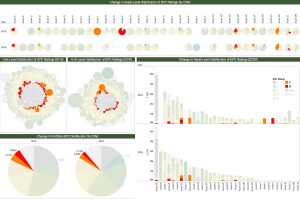

As in most circumstances where there is uncertainty or doubt, landlords facing the prospect of MEES will be best placed if they can reduce the potential impact of uncertainties. In this regard, ensuring that they have as much relevant information as possible will be vital and to do that, landlords must review their portfolios with a view to understanding where there MEES risks lie at individual asset level. Having high quality information is vital, as is drawing upon sufficient expertise to undertake risk-based thinking which accounts for EPC data in the context of factors such as rental income at risk due to lease events, lease types and provisions as well as forthcoming asset management activities. Savvy landlords will also review their leases to better understand how they can provide protection of rental income from MEES risks.

Final thoughts

The MEES regulations rely upon EPCs which are not an ideal basis for such regulations given their all-too-frequent inadequacies. The blame for this can be spread far and wide but should in part land on those who procured EPCs very cheaply and got sub-standard results – they are now reaping what they sowed. There is a role for landlords, the property industry generally and for government in dealing with inevitable mess:

- Landlords must attend to the risks in their portfolios by procuring high quality advice and data reviews;

- the property industry, principally professional and accreditation bodies, must ensure that EPC provision improves radically and quickly; and

- the government must clarify outstanding and confusing issues with competent guidance, keeping an eagle eye on how MEES is rolled out.