Streamlined Energy & Carbon Reporting (SECR) – a Hillbreak perspective

The UK Climate Change Act 2008 was one of the earliest comprehensive framework laws on climate change globally, setting a goal of an 80% reduction in carbon emissions (from 1990 levels) by 2050. On the advice of the Committee of Climate Change (CCC), the UK government responded by putting in place successive, five-year carbon budgets that run to 2032.

Progress was initially strong, but the CCC’s most recent report (June 2018[i]) suggests the UK is on track to miss the fourth (2023-27) and fifth carbon (2028-32) budgets. The report notes that emissions have fallen 43% since 1990, but that “progress so far has been driven by the power and waste sectors, while emissions from transport, buildings and agriculture have plateaued”.[ii]

These sectors, therefore, present an ongoing risk to missing future carbon budgets unless progressive incentives and policy changes decisively commit them to emissions reduction programmes. Indeed, emissions from the buildings sector in real terms actually increased by 1% between 2016 and 2017.[1] [iii]

The CCC recommends the building sector increases the insulation of homes (insulation rates were 95% lower in 2018 vs 2012[iv]), upgrades as many homes as possible to at least a C-rated EPC by 2035, and phases out all high-carbon fossil fuel heating. It also flags the need to widen the use of operational data for benchmarking in the public and commercial sectors and references the introduction of Streamlined Energy and Carbon Reporting Scheme (SECR) for businesses.

SECR – a burden or a blessing?

SECR, which came into effect on 1st April 2019, is designed to simplify and align policies relating to energy efficiency. It replaces the Carbon Reduction Commitment (CRC)[2] Energy Efficiency Scheme, with a view to widening the incentive for more organisations to save energy through energy efficiency: around 2,000 companies participated in the CRC, while SECR mandates reporting for almost 12,000 companies.[v]

Acting alongside the Climate Change Levy, the SECR opens up reporting requirements to a wider group of energy consumers which, in theory, should increase transparency and shared intelligence to help drive energy efficiency across a range of sectors.

Organisations required to comply with SECR will include quoted companies, ‘large’[3] unquoted companies and ‘large’3 LLPs. The Companies (Directors’ Report) and Limited Liability Partnerships (Energy and Carbon Report) Regulations 2018, which came into force on 1 April 2019, require these organisations to include the new reporting requirements[4] either within their Directors’ Reports or, if a ‘large’ LLP, through a new Energy and Carbon Report.

Reporting requirements, which need to be addressed in the Annual Report & Accounts, include disclosure of:

- energy use – electricity, natural gas, self-supplied energy and transport;

- all carbon emissions;

- an intensity metric (e.g. normalised against FTE, turnover, floor area etc.); and

- all principal energy efficiency measures taken throughout the financial year.

Arguably, the implied ‘streamlining’ of energy and carbon reporting is a bit of a red herring. The requirements are actually rather extensive in scope.

Reporting efficiency measures marks a notable change for those previously participating in CRC or mandatory GHG reporting, particularly given that organisations must also declare publicly if no such measures have been implemented within the reporting year. The requirement to disclose whether or not action has been taken should amplify the pressure on continuous improvements being made at the source of consumption, ensuring that those benefiting from the decarbonisation of the grid, and other external factors, are also taking on the responsibility in-house to mitigate against rising carbon emissions. Given the groundswell of public attention being focused on corporate climate action, particularly by the Extinction Rebellion movement, the ultimate outcome should be progressive improvements across a range of sectors, including those yet to contribute positively to the UK’s carbon budgets. It is quite likely that financial services and related companies will be in the spotlight.

The fiscal escalator….

Another key change being brought into effect is the significant increase in the energy consumption tax – the Climate Change Levy (CCL) – which will offset the revenue lost to the Exchequer from the withdrawal of the CRC, and will sit alongside the introduction of SECR.

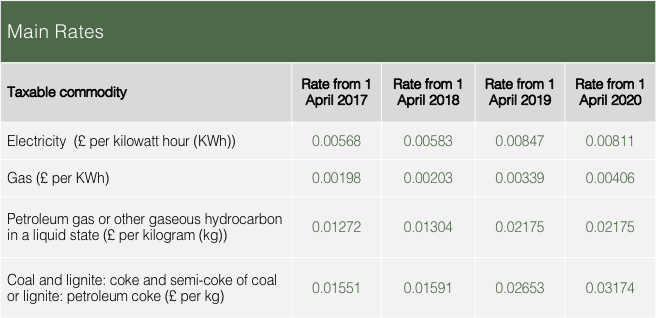

In contrast to previous increases of less than 3% annually, from 1st April 2018 to 1st April 2019 the Government raised the CCL by 45% for electricity and 67% for natural gas[vi] (see table below). Although there is no indication of plans to raise the rate further, there are strong indications that further increases will occur in future fiscal years.

This increase in the CCL is designed to continuously incentivise energy performance across a wide group of businesses and to encourage the continued substitution of gas energy for electricity, thereby reducing associated emissions. This change could prove to be a powerful driver towards improved energy efficiencies, especially for those organisations not previously captured by the CRC.

Table 1: Main rates for the CCL as of 1st April 2019[i]

This increase could add a sizeable amount to an organisation’s annual energy bill[i]. For example, a CRC non-participant who consumes 1,000,000 kWh of electricity and 1,000,000 kWh of natural gas each year, with an energy bill of roughly £140,000 annually, could expect an additional £4,000 of CCL charges through the current CCL changes.

Will it have the desired effect?

A landmark report[ii] authored by Jon Lovell and Miles Keeping in 2014 during their time at Deloitte, on behalf of the Green Property Alliance and the Green Construction Board, found that policy instruments which have a broad impact by amplifying the price of energy consumed, or which require processes to be undertaken (such as reporting) without imposing a clear obligation for positive action, are found to be relatively ineffective. This is due to the relative inelasticity of energy demand within the commercial property sector and the lack of a direct incentive for operational implementation.

However, one must now question whether the significant hike in CCL will provide a greater degree of stimulus, particularly given stronger emphasis on the net operating income performance of UK investment property than has been the case historically. Certainly, a clearly programmed and transparent price escalator over successive fiscal years would likely make a real difference, much in the same way as the Landfill Tax did for the waste sector. Equally, in the age of Greta Thunberg, #youthstrike4climate, and the Extinction Rebellion movement, the reputational implications of greater disclosure will undoubtedly be stronger than has been the case hitherto as well.

Collectively, SECR and CCL can therefore be expected to compel a wider pool of organisations more strongly than has been the case with preceding arrangements – including building owners and their occupier customers. Implementing the requirements should be more straightforward in the context of leased property that the CRC too, which may overcome some of the disapproving sentiment that was particular apparent within the UK real estate industry.

Official estimates suggest the introduction of SECR and the changes in the CCL rate will result in energy savings of £2,856m – as well as improvements in air quality, carbon savings and a reduction in noise pollution[i]. £262m of annual bill savings are also expected as an indirect result of reporting. The actual effect of the combined new arrangements remains to be seen, of course.

Climate change is unquestionably one of the most urgent and intractable issues currently facing the world, presenting an ongoing and increasing risk to communities, investments and businesses globally. With the scale of change required – particularly within the built environment and other sectors yet to contribute to the UK carbon budgets – SECR and CCL feel like progressive sticks to get the market moving in the right direction towards a low, perhaps even zero, carbon economy by 2050.

References:

[1] Accounting for adjustments relating to annual winter temperature increases.

[2] A levy on those companies with at least one settled half hourly electricity meter (sHHM) and used 6,000 megawatt hours or more of qualifying electricity supplied through settled half hourly meters.

[3] Large is defined as having two or more of the following: >£36m turnover; >18m balance sheet; >250 employees.

[4] All starting on their first financial year on or after 1 April 2019

[i] Committee on Climate Change (June 2018) Reducing UK emissions, 2018 Progress Report to Parliament. Accessed 30/04/19 https://www.theccc.org.uk/wp-content/uploads/2018/06/CCC-2018-Progress-Report-to-Parliament.pdf

[ii] Carbon Brief (28th June 2018) ‘Worrying trend’ in UK emission cuts beyond power and waste, says CCC. Accessed 30/04/19 https://www.carbonbrief.org/worrying-trend-uk-emission-cuts-beyond-power-waste-says-ccc

[iii] Committee on Climate Change (June 2018) Reducing UK emissions, 2018 Progress Report to Parliament. Accessed 30/04/19 https://www.theccc.org.uk/wp-content/uploads/2018/06/CCC-2018-Progress-Report-to-Parliament.pdf

[iv] Committee on Climate Change (June 2018) Reducing UK emissions, 2018 Progress Report to Parliament. Accessed 30/04/19 https://www.theccc.org.uk/wp-content/uploads/2018/06/CCC-2018-Progress-Report-to-Parliament.pdf

[v] Ecoact (6th February 2019) Ten things you should know about the new energy and carbon reporting regulations. Accessed 30/04/19 https://eco-act.com/2019/02/ten-things-you-should-know-about-the-new-energy-and-carbon-reporting-regulations/

[vi] Carbon Credentials (13th September 2018) Impact of Changing CCL rates. Accessed 30/04/19 https://carboncredentials.com/impact-of-changing-ccl-rates/

[i] Department for Business, Energy & Industrial Strategy (18th July 2018). Streamlined energy and carbon reporting framework. Accessed 30/04/19 https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/725912/SECR_and_CRC_Final_IA__1_.pdf

[i] Carbon Credentials (13th September 2018) Impact of Changing CCL rates. Accessed 30/04/19 https://carboncredentials.com/impact-of-changing-ccl-rates/

[ii] Deloitte (March 2014) Carbon Penalties & Incentives. Accessed 11/05/19 https://www2.deloitte.com/uk/en/pages/real-estate/articles/carbon-penalties-and-incentives-report.html