Chaillot Declaration

Could this be a fossil fuels moment for the Built Environment sector? The Chaillot Declaration, which now underpins the Buildings Breakthrough agenda, is certainly a big step forward. But there are several areas in which we’d like to have seen it strengthened. Hillbreak Managing Director, Jon Lovell, explains…

Jon Lovell, Managing Director at Hillbreak

Context

For nearly three decades, successive gatherings of the Conference of the Parties (COP) to the UN Framework Convention on Climate Change (UNFCC) failed to acknowledge the principal driver of our crashing climate: the unabated use of fossil fuels to power the global economy. That was, until COP28 in late 2023.

Let’s not pretend that COP28 landed anywhere near the level of global commitment needed to avert climate catastrophe, but let’s also not ignore the foundational significance of a first fossil fuels namecheck – and an agreement to “transition away” from them – in its concluding agreement.

There was another major moment at COP28 too: the Buildings Breakthrough – a global push for “near zero emission and resilient buildings by 2030”. After years of its huge, demand-led impact on our global climate being largely overlooked, suddenly the sector had a proper, galvanising call to action, endorsed by 27 countries representing around 34 per cent of the global population, about 51 per cent of global emissions, andapproximately 64 per cent of GDP.

Responsibility for coordinating action under the Breakthrough agenda falls to the Global Alliance for Buildings & Construction. It met in Paris just over a week ago at the first Buildings & Climate Global Forum, at which a notable Ministerial Declaration, the Chaillot Declaration”, was struck.

A landmark moment on climate for the built environment sector

This is a very welcome step forward, bearing in mind:

- The scale of the impacts of the building sector on climate, nature, pollution, resource consumption, human rights (check out some of the mind-blowing stats in the Declaration itself).

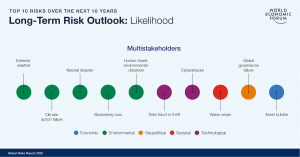

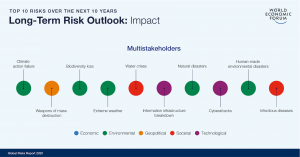

- The gravity of the ‘polycrisis’ we now face regarding the collapse of ecosystems, the breakdown of our climate, diminishing availability of key resources, and growing social inequality.

- The complexity of the building sector and the wide-ranging interventions and transformations that are needed to address these impacts.

- The enormous potential that exists for building-related sectors to realise transformational change, subject to radical fiscal, regulatory, technological and behavioural innovation.

- The fact that all of these attributes of the buildings sector have for too long been largely overlooked by policy-makers globally.

Everyone involved in the conception, delivery, financing, trading, ownership, management, servicing, regulation, leasing and occupancy of buildings should read the Declaration. It provides:

- a useful summary of the various international agreements and goals which rely on coordinated action across our sector (including those pertaining to climate, nature, pollution and human rights) for their successful implementation;

- a concise analysis of the scale and scope of the challenge and the many efforts that are needed to bridge the gap between these goals and the reality of current and projected sector-related impacts; and

- a catalogue of strategic actions for the now 70 endorsing nations to take forward within their individual jurisdictions.

Areas in need of further emphasis and action

Whilst there is much to get behind and advocate (and, as an industry, we really must do that), I think the Declaration misses a few key points. In particular, I would like to see further attention on the following:

- Bolstering some of the objectives with a more comprehensive level of ambition; the scope is currently too narrow in places. For example, biodiversity and soil health emphases are certainly warranted, but what about nature recovery and the integrity of ecosystem services more broadly? Minimising further soil sealing through the urbanisation process stands to reason, but what about repairing the damage already done in brownfield locations through environmental regeneration?

- As well as pointing to the need for supportive fiscal and regulatory frameworks (which I certainly don’t disagree with), there could be clearer reference to the fact that many current laws and policies relating directly and indirectly to buildings and the wider urban system are actually barriers to the transition which need to be systematically identified and removed. The signal is for more new enabling stuff, rather than addressing existing disabling stuff (e.g. perverse tax disincentives, restrictive landlord and tenant law etc.). We need action on both so that the whole legal and policy system is pointing in the same transitionary direction!

- Rather than calling for more (MORE??!!) standards, labels and certifications, I’d rather see it calling for better ones and for these to be adopted more widely and consistently across markets and geographies – attuned to local conditions, of course.

- Building on the promotion of collaborative value chains, the importance of which cannot be understated, I’d like to see stronger reference to the need for this to be effectively joined-up across the building (including investment and financing) lifecycle, so that whole life impacts of buildings and urban systems are more comprehensively and effectively addressed. Whilst there is considerable emphasis on whole life carbon approaches in the document generally, it doesn’t acknowledge how siloed individual participants in the market and value chain can be.

- In addition to the call for enhanced skill capacity (which, as a firm with a key focus on client learning we certainly endorse!), I’d like to see a stronger challenge laid at the door of professional bodies to enhance their standards and educational programmes – again, throughout the value chain – so that these are fit-for-purpose in the context of the crises we face.

- An acknowledgement of the economic and financial benefits of getting this right for all stakeholders in the value chain and the capital stack. Apathy amongst market participants remains a major obstacle to realising market transformation; let’s take every opportunity to make the business and investment case for delivering on a concerted transition effort across the whole of the sector.

- Finally, we need to get real about the scale of the climate impacts we are now facing, and the likely extent to which these are going to get more severe. We really should be seeing a massive push for internationally-coordinated efforts to develop national strategic plans for housing and social infrastructure, not only to address the inadequacies in existing supply, but to ensure that climate-driven mass migration is effectively managed. This is not just a question of quantum, but also of resilience, social cohesion and meeting the health and wellbeing needs of all affected populations. I realise that prevailing political discourse in what is a momentous year for the global electorate doesn’t exactly create a comfortable tone for this sort of conversation. But that shouldn’t mask the reality of the need.